Dielectric Ceramics Overview

1.1 Definition

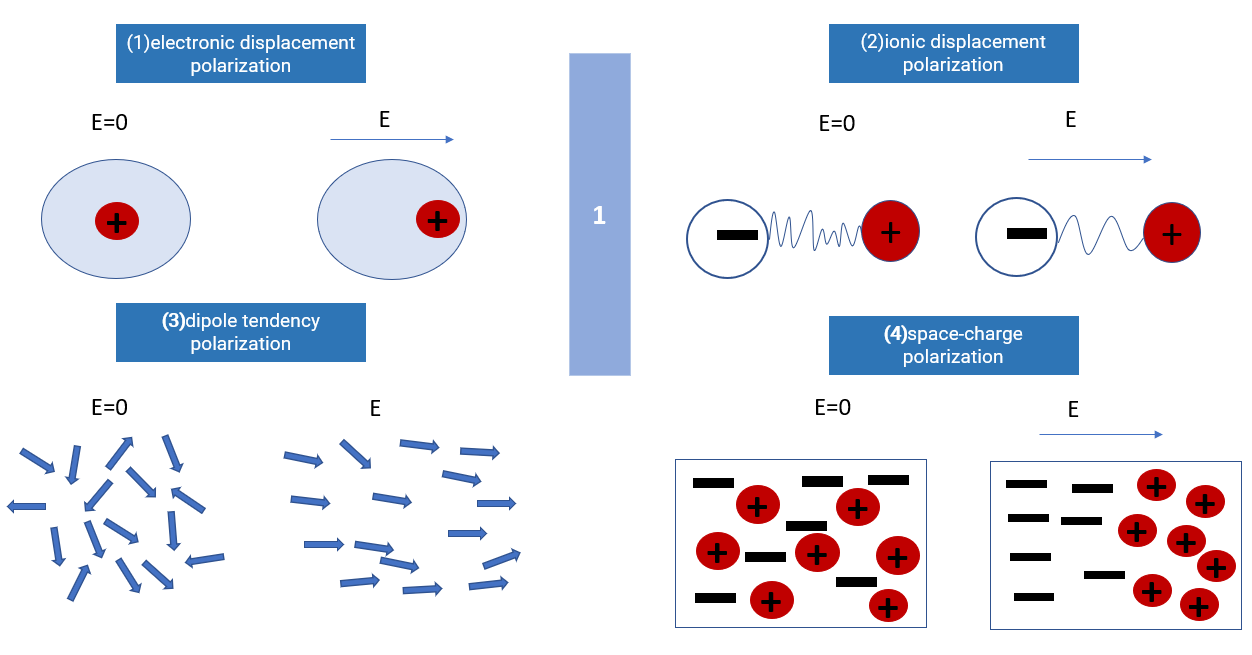

Dielectric ceramics are functional ceramics that have polarization ability under the action of electric field and can establish electric field in vivo for a long time. Dielectric ceramics are characterized by high insulation resistance, high voltage resistance, low dielectric constant, low dielectric loss, high mechanical strength and good chemical stability. They are mainly used in capacitor and microwave circuit components.

1.2 Classification

According to the propreties, dielectric ceramics can be divided into non-ferroelectric ceramics and ferroelectric ceramics.

Permittivity (K) is used to measure the properties of stored electric energy in dielectric ceramics. According to permittivity classification, dielectric ceramics can be divided into low permittivity, medium permittivity and high permittivity 3 types.

Low permittivity ceramics (K<12)

3MgO·4SiO2·H2O, 2MgO·SiO2, 2MgO·2Al2O3·5SiO2, α-Al2O3, BeO, α-BN、β-BN

Medium permittivity ceramics (12<K<1000)

TiO2, CaTiO3, MgO-TiO2, CaSnO3, CaTiO3, ZrTiO4

High permittivity ceramics (K>1000)

BaTiO3-BaSnO3, BaTiO3-CaSnO3, BaTiO3-BaZrO3, BaTiO3-SrZrO3-CaTiO3, Pb(Mg1/3Nb2/3)O3-PbTiO3一Ba(Zn1/3Nb2/3)O3

1.3 Applications

Dielectric ceramics are mainly used in ceramic capacitors and microwave dielectric components.

Ceramic capacitor is an essential component of electronic circuit, can be divided into single layer ceramic capacitors, MLCC capacitor and lead type multilayer ceramic capacitor, high/low voltage ceramic capacitors, MLCC occupie about 93% of the ceramic capacitor market.

Microwave dielectric components mainly used for the microwave devices such as resonator, coupler, filter, and the microwave dielectric substrate.

Ceramic capacitors applications:

• Consumer electronics • Automotive electronics • Industrial machinery • Military equipment

Microwave dielectric components applications:

•Information and communication • Aerospace • New energy • Military industry

Dielectric Ceramics Industry Analyses

2.1 Industry chain structure

The upstream of the dielectric ceramics industry chain is generally making chemical raw materials into powder, the midstream includes various dielectric ceramics components, and the downstream includes applications such as consumer electronics, automotive electronics, aerospace and military industry and other fields.

The technology and production capacity of components impact the development of the entire electronic industry, so they play a vital fundamental role.

2.2 Key materials & technology

Dielectric ceramic components products are not difficult in theory, what difficult is to keep improving during the manufacturing process. It takes a long time of "know-how" accumulation to produce high-quality products.

Generally, the "know-how" accumulation is reflected in 3 points: material, equipment and process.

Material:

It is difficult to determine the production technology, formula and performance of materials in advance, so it is necessary to keep trying and improving in the actual production process. This process needs a long time to accumulate, and it also needs to keep improving mentality, so that the ratio and performance of materials can be improved continuously.

Equipment:

As standardized equipment doesn't meet the individual needs of enterprises, they are required to transform the equipment according to their understanding of materials and processes. The plan of equipment modification is not determined in advance, so it needs the stuffs to continuously trying & improve during the manufacturing process.

Process:

Various manufacturing methods and precision control can't be obtained through theoretical planning in advance, need to keep constantly trying & improving during the practical application process, achieve and get better results through the progressive process.

2.3 Competition pattern

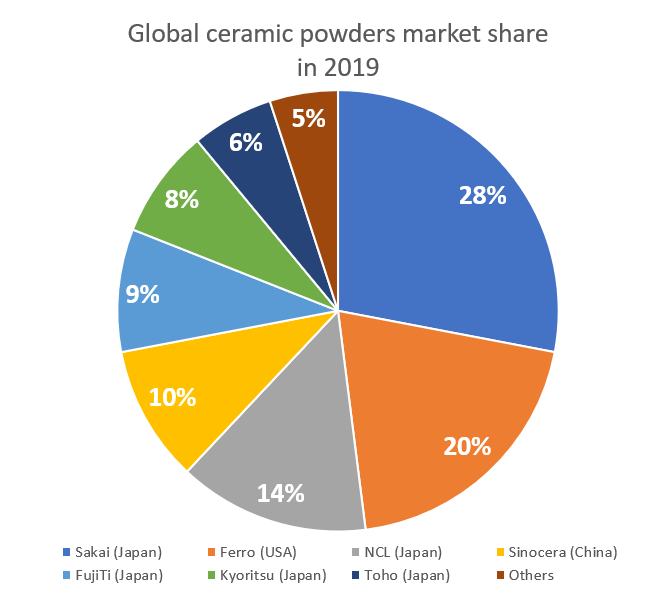

For advanced ceramic technology, powder preparation is one of the most important technologies. The manufacturing technology of high purity, ultrafine and high performance ceramic powder is the key point.

About 65% of the global electronic ceramic powder materials market is occupied by Japanese company, Sakai Japan electronic ceramic powder materials occupie about 28% global market share, Ferro USA takes about 28%, and Japanese chemical NCI takes 14%.

2.4 Porter's 5 forces analysis

- Competitive rivalry: With the continuous update and development of the electronics industry, the downstream market demand is growing. Dielectric ceramic powder suppliers are mainly in Japan, USA and South Korea. Chinese enterprises meets a large mutual competition in domestic.

- Threat of new entrants: Production technical barriers are high and new entrants pose little threat.

- Bargaining power of suppliers: Not too much enterprises have mass production capacity, and the market demand is large, the bargaining power of suppliers is strong.

- Bargaining power of customers: The replacement of electronic products is fast, and the quality suppliers are not too much, the bargaining power of customers is weak.

- Threat of substitutes: Ceramic materials have excellent properties, with a demand-oriented in new markets, the substitutes have weak threat.

Dielectric Ceramics Market Analyses

3.1 Ceramic capacitors

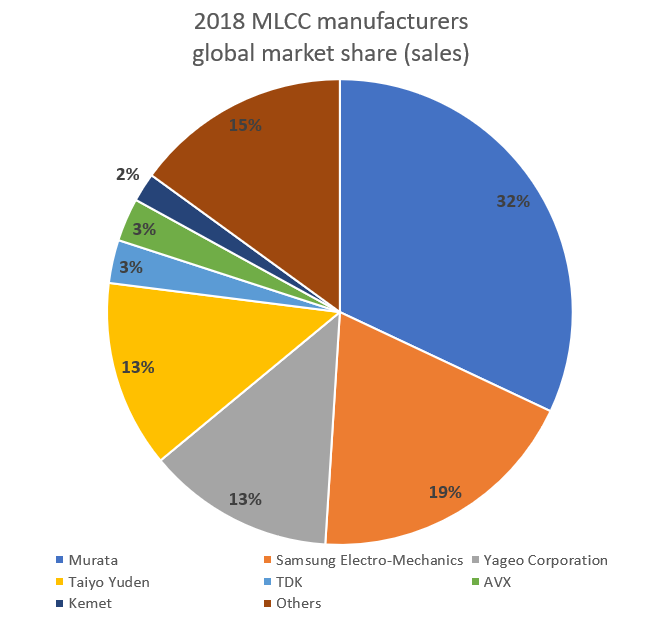

For ceramic capacitors (example MLCC), Murata and Samsung Electro-Mechanics have 32% and 19% market shares respectively, both of them occupy more than half of the global market.

Among the global top 10 MLCC manufacturers, Japanese manufacturers accounted for more than 44%, because Japanese manufacturers lead in high-volume products, ceramic powder technology and production capacity.

From 2016 to 2019, the global ceramic capacitor market scale is 9.2, 11.5, 16.9 and 17 billion usd. Benefit from the demand growth in the downstream market, the global ceramic capacitor market is estimated to reach 19.6 billion usd in 2023.

China keep the same demand growth as the global market , and chinese market is one of the major markets of ceramic capacitors, the market scale is estimated to reach 57.4 billion yuan in 2023. (1usd ≈ 6.5yuan)

3.2 Microwave dielectric ceramics

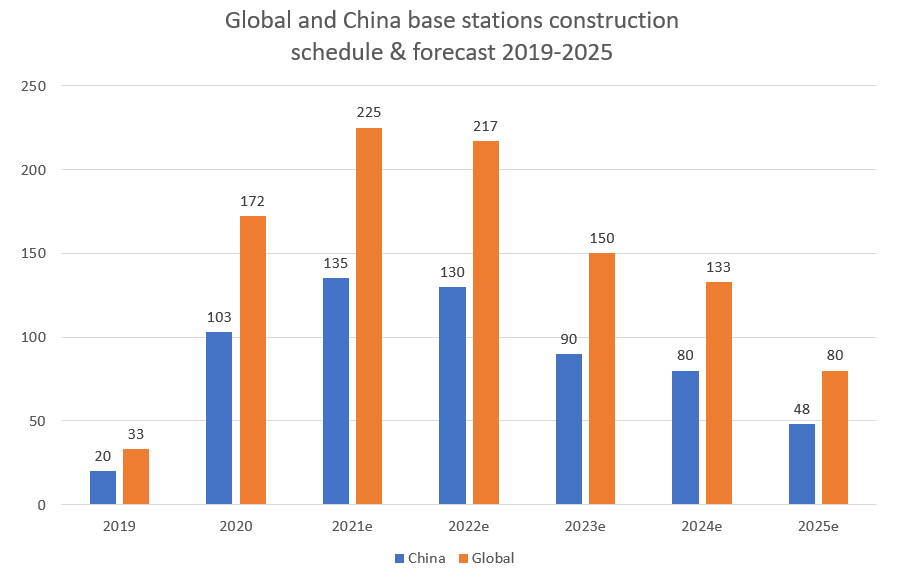

The information and communication industry is the main driving force for the development of microwave dielectric ceramics. With the accelerated commercial process of 5G, microwave dielectric ceramics with excellent functional applicability, will be used as an important component of 5G communication equipment to replace the original metal material components, containing a broad market growth space.

Microwave dielectric ceramics (example MLCC), in 5G base station equipment, filters occupy the largest share of rf front-end devices. Due to 5G equipment's weight and volume will be more stringent than 4G's, the filters must be more miniaturized and integrated, and the ceramic dielectric filters with smaller volume and lighter weight will gradually become the mainstream application.

The estimated increasement of new acer station in China wll be about 6.06 million pcs, during the same period the global new acer station will increase 10.1 million pcs. Reckons the whole 5G period, the global filter market demand will reach 9.5-10 billion usd.

Dielectric Ceramics Market Growing Trend

In the new generation of information technology industry of key applications, for the key development of integrated circuits and its manufacturing equipments, information and communication equipment, electronic ceramics is one of the key strategic materials.

For ceramic capacitors, the trend is ultra-small, high capacity, high frequency, low cost and green development.

For microwave dielectric ceramics, they must meet the requirements of miniaturization, integration, high reliability and low cost of microwave circuits. With the development of mobile communication and modern electronic equipment, microwave dielectric ceramics have broad prospects for future development.

声明:本文由 CERADIR 先进陶瓷在线平台的入驻企业/个人提供或自网络获取,文章内容仅代表作者本人,不代表本网站及 CERADIR 立场,本站不对文章内容真实性、准确性等负责,尤其不对文中产品有关功能性、效果等提供担保。本站提醒读者,文章仅供学习参考,不构成任何投资及应用建议。如需转载,请联系原作者。如涉及作品内容、版权和其它问题,请与我们联系,我们将在第一时间处理!本站拥有对此声明的最终解释权。